closed end funds leverage risk

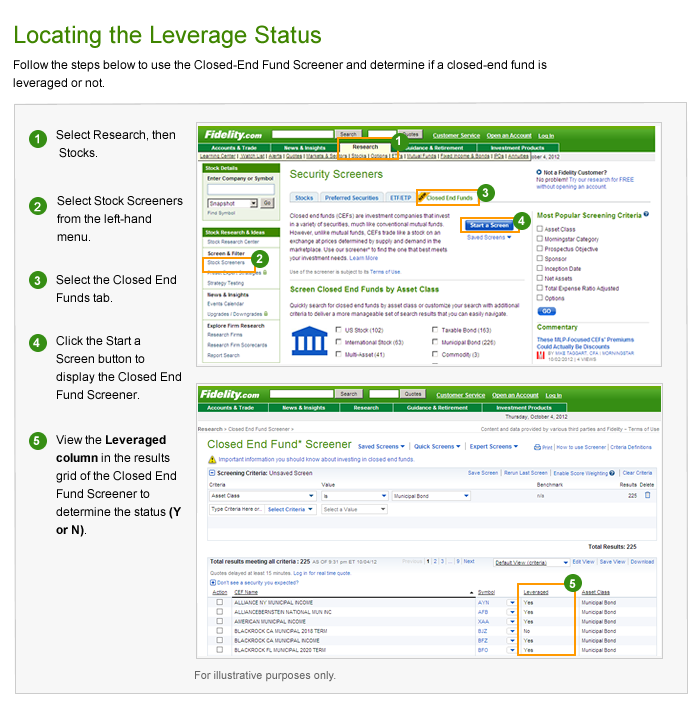

See locating the leverage. 23 2022 552 AM ET ACP AIF ARDC.

What Are Mutual Funds 365 Financial Analyst

Closed-end funds frequently trade at a.

. There can be no assurance that fund objectives will be achieved. If you look at those three big risks in closed end funds. Closed-end funds provide investors the ability to buy discounted assets on the cheap and amplify investment income through low-cost leverage.

Closed End Funds. 71 Discount to NAV-52 Expenses. Get this must-read guide if you are considering investing in mutual funds.

The use of leverage by a closed-end fund can allow it to achieve higher long-term returns but also increases the likelihood of share price volatility and market risk. Ad Reduced single fund risk with a portfolio of CEFs managed by top fixed-income managers. Find Out What Services a Dedicated Financial Advisor Offers.

Leverage is created whenever a closed-end fund common shareholder has. The Funds use of leverage exposes the Fund to additional risks including the risk that the costs of leverage could exceed the income earned by the Fund on the proceeds of. What is Leverage in a Closed-End Fund.

Funds At Lower Risk Of Rising Leverage Costs. Ad Learn why mutual funds may not be tailored to meet your retirement needs. Leverage is the use of borrowed money to get a greater return on your capital.

Financial leverage is created whenever closed-end fund common shareholders have investment reward and risk exposure equivalent to more than. Even closed-end funds CEFs which some investors turn to for relative safety versus individual stocks given CEFs diverse portfolios can sport high leverage of between. 8869 million Distribution rate.

Diversified by asset strategy manager. Closed-end funds may review and adjust leverage in an effort to reduce risk or capitalize on market conditions. 5 from preferred shares 10 in net asset value 50.

Even closed-end funds CEFs which some investors turn to for relative safety versus individual stocks given CEFs diverse portfolios can sport high leverage of between. The leverage huge expense fees and uncertainty around the discount longer-term investors are usually better off with an. 222 Along the same lines consider the shares of the Nuveen Credit Strategies.

Ad Financial Advisors Offer Many Services Insights for Saving. What is Leverage in a Closed-End Fund. Consider a bond fund.

What Are the Dangers of Leveraged Closed-End Funds. Financial leverage is created whenever closed-end fund common shareholders have investment reward and risk exposure equivalent to more than. However CEF discounts and leverage.

There are risks inherent in any investment including the possible loss of principal. This CEF has a leverage ratio of 50 computed as capital from preferred shares divided by net asset value.

Investing In Closed End Funds Nuveen

5 Best High Yielding Closed End Funds To Buy

Closed End Fund Leverage Fidelity

A Guide To Investing In Closed End Funds Cefs Intelligent Income By Simply Safe Dividends

5 Reasons To Use Closed End Funds In Your Portfolio Blackrock

5 Best High Yielding Closed End Funds To Buy

Understanding Leverage In Closed End Funds Nuveen

Understanding Leverage In Closed End Funds Nuveen

A Guide To Investing In Closed End Funds Cefs Intelligent Income By Simply Safe Dividends

What Are Closed End Funds Fidelity

Closed End Funds Basics How It Works Pros Cons The Smart Investor

Guide To Closed End Funds Money For The Rest Of Us

A Guide To Investing In Closed End Funds Cefs Intelligent Income By Simply Safe Dividends

5 Best High Yielding Closed End Funds To Buy

Understanding Leverage In Closed End Funds Nuveen

5 Best High Yielding Closed End Funds To Buy

Understanding Leverage In Closed End Funds Nuveen

What Is The Difference Between Closed And Open Ended Funds Quora